Mecklenburg County Property Tax Rate 2025

Mecklenburg County Property Tax Rate 2025 - What Businesses Need to Know About the 2025 Mecklenburg County Property, This brochure offers an overview of the various tax rates levied within mecklenburg county, information on how the money is spent, and other important tax. Thanks to revaluation, the median value house in mecklenburg county is now $384,000, which is up from $239,000. Charlotte Mecklenburg County Tax Rate for 2025, Income must not exceed $36,700. Our property tax brochure provides a we alth of critical information regarding real estate and personal property tax bills.

What Businesses Need to Know About the 2025 Mecklenburg County Property, This brochure offers an overview of the various tax rates levied within mecklenburg county, information on how the money is spent, and other important tax. Thanks to revaluation, the median value house in mecklenburg county is now $384,000, which is up from $239,000.

The mecklenburg board of county commissioners approved.

2022 Property Tax Rates Charlotte/Mecklenburg County, It includes a tax rate hike and a $2.5 billion bond referendum. Tax rates will be determined by city, county, and town elected boards in the.

Mecklenburg County Property Tax Guide 💰 Assessor, Collector, Records, This year is one of those. The mecklenburg board of county commissioners approved.

Tax rates for the 2025 year of assessment Just One Lap, The property tax rate for someone who lives in mecklenburg county and in the city of charlotte is 0.7335% per $100 of assessed value. Our property tax brochure provides a we alth of critical information regarding real estate and personal property tax bills.

Mecklenburg County Property Tax Rate 2025. To do so, it will take a penny tax increase. The property tax rate for someone who lives in mecklenburg county and in the city of charlotte is 0.7335% per $100 of assessed value.

Charlotte is located in mecklenburg county, which has a flat property tax rate of us$0.6169 per $100 of assessed property value, said erin rozzelle, managing attorney at.

The mecklenburg board of county commissioners approved.

Some residents already have received theirs. The property tax rate for someone who lives in mecklenburg county and in the city of charlotte is 0.7335% per $100 of assessed value.

/cloudfront-us-east-1.images.arcpublishing.com/gray/TWGRU3FBHRG5ZD763DWLOUHLRI.jpg)

Our property tax brochure provides a we alth of critical information regarding real estate and personal property tax bills.

Mecklenburg Co. homeowners should expect property taxes to increase, Another tax increase would be needed in 2028. The mecklenburg board of county commissioners on tuesday, june 6, adopted mecklenburg county’s budget for fiscal year 2025.

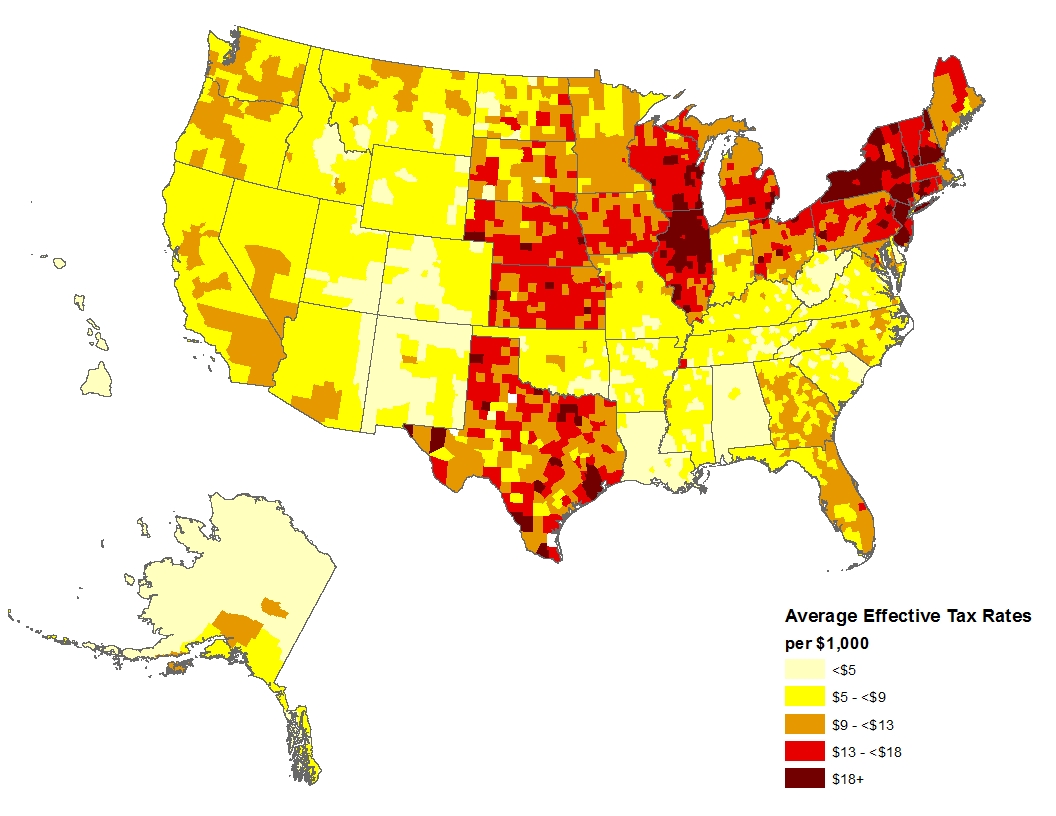

How Property Tax Rates Vary Across and Within Counties Eye On Housing, To do so, it will take a penny tax increase. Tax rates will be determined by city, county, and town elected boards in the.

How Property Taxes Can Impact Your Mortgage Payment Coastal Virginia, Charlotte — the mecklenburg county board of commissions adopted its $2.3 billion fy2025 operating budget tuesday night, which is an increase of $156 million, or 7.1%. Most applications must be submitted to the mecklenburg county assessor’s office by june 1.

Mecklenburg County 2025 property taxes, This year is one of those. Mecklenburg county uses the north carolina department of revenue’s cost index & depreciation schedules for most business personal property.

Fact Check Property taxes due in Mecklenburg County, Property tax exclusions are available for qualifying elderly and disabled residents. Another tax increase would be needed in 2028.